Subdued Sales Outlook for Portuguese Housing Market

Portugal's housing market faces mounting pressure and dwindling sales as demand for home purchases continues to decline. This downward trend shows no signs of abating in the near future, with the uncertainty surrounding the "Mais Habitação" initiative and rising interest rates acting as the primary catalysts.

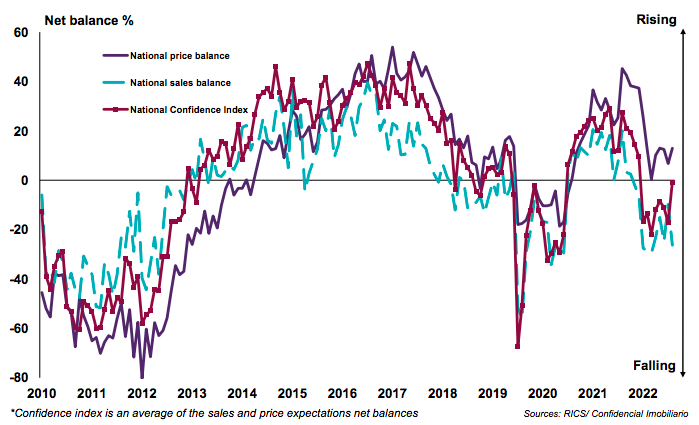

The April 2023 RICS/Ci PHMS results indicate a subdued sales market with negative indicators for new buyer enquiries and agreed sales. However, the lettings market continues to show strong demand, leading to higher rental prices. The new buyer enquiries indicator for the sales market returned a net balance of -31% in April, signaling a downturn in buyer demand. This negative trend has persisted for twelve consecutive months. At a regional level, all regions are experiencing negative readings, although the Algarve showed a slight improvement in buyer demand compared to the previous month.

Chart 1: Sales market indicators

In April, +13% of respondents reported price increases, and looking ahead, +28% of respondents expect prices to continue climbing over the next 12 months. Meanwhile, rental demand continues to surge, indicated by a net balance of +40% of respondents (similar to March's +35% reading). Despite this, new instructions from landlords remain in negative territory at -24%. As a consequence, rents are being driven upward, and further short-term increases are anticipated.

Additionally, new instructions, which refer to the number of properties being put up for sale, remain subdued with a net balance of -20% of respondents reporting a fall in April. Overall, these findings suggest that the Portuguese housing market is currently facing challenges, with lower buyer demand and limited supply. "For the agents surveyed, the uncertainty resulting from the Mais Habitação package is affecting buyers and investors, putting pressure on sales, which remain below 2022 levels. Added to this are the adverse conditions in the credit market… … As a result, rents are seeing additional inflationary pressure," noted Ricardo Guimarães, director of Confidencial Imobiliário.

Chart 2: Lettings market indicators

‘‘The Portuguese economy expanded by a solid 1.6% during Q1, leaving GDP 4.3% higher than before the pandemic. Looking ahead, economic growth across the country is now expected to come in close to 2.5% for 2023 as a whole, comfortably above the average for the euro area in aggregate,” explained Tarrant Parsons, Senior Economist at RICS. “Despite the generally resilient economic backdrop overall, higher interest rates continue to take their toll on housing market activity, with near-term expectations continuing to portray a subdued outlook.”

Disclaimer: The views expressed above are based on industry reports and related news stories and are for informational purposes only . SSIL does not guarantee the accuracy, legality, completeness, reliability of the information and or for that of subsequent links and shall not be held responsible for any action taken based on the published information.